About Us

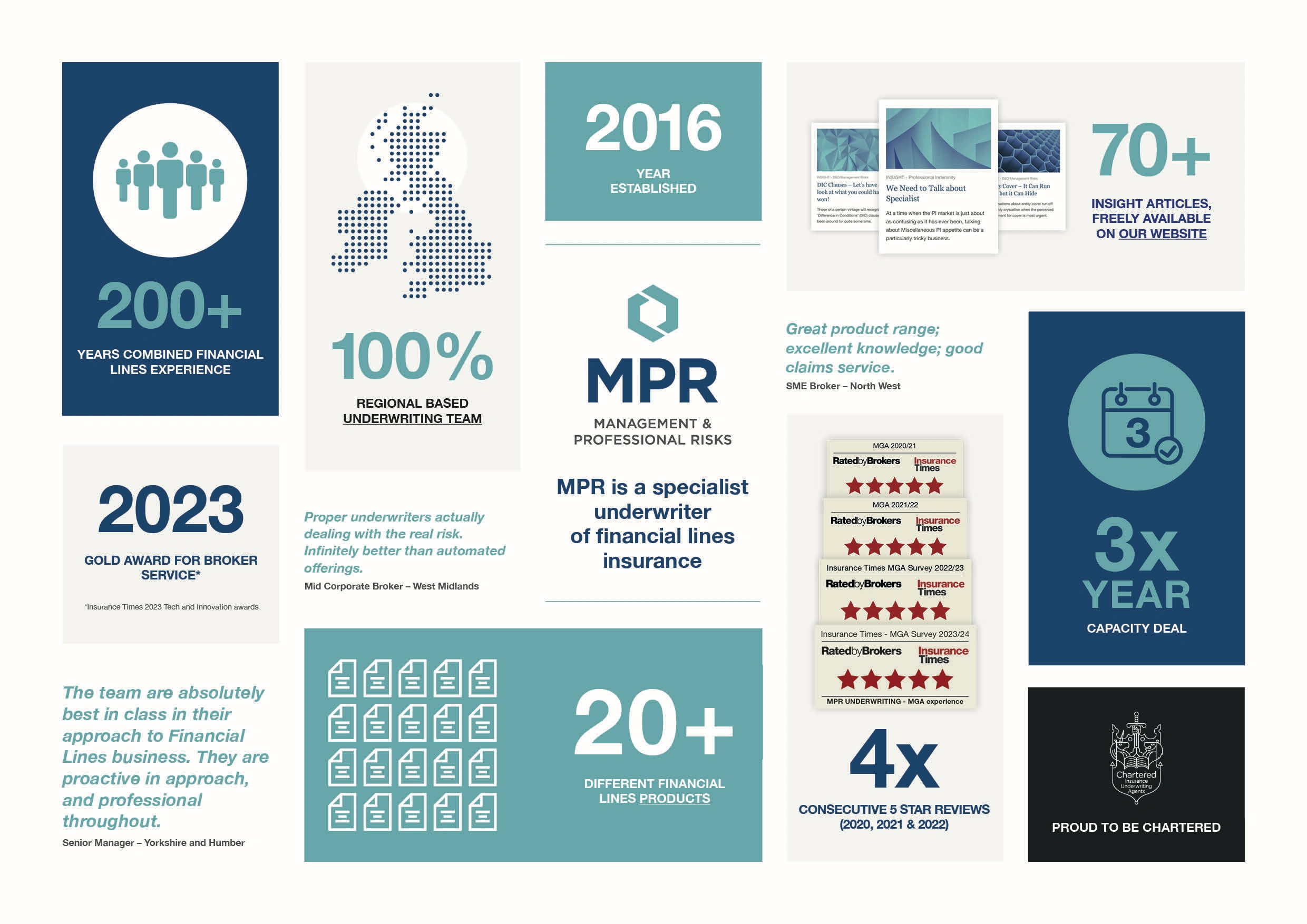

MPR is a specialist underwriter

of financial lines insurance

We work directly with brokers to help you navigate a complex, invisible world – the world of laws, regulations and duties that govern how individuals and organisations connect and interact.

Why we exist

Over the last twenty years, we’ve witnessed huge changes in financial lines insurance.

First, the good news

Financial lines insurance is becoming better known – and for good reason, because today these policies are more necessary than ever before. From established coverage areas like D&O Liability, to the fast-changing world of cyber liability, the policies we write are making organisations of all kinds more solid and more resilient.

We work flexibly, have the authority to make decisions without passing the buck, and our underwriting skills are always at your disposal.

But second, the bad news

The industry-wide quest for efficiency – and the resulting automation and standardisation – are taking underwriting expertise away from insurer front-lines. Technological efficiency is important, and absolutely has a place. But, we believe, not at the expense of close relationships between underwriter and broker. It’s in no-one’s interests for underwriting skills to be locked away behind layers of bureaucracy.

We set up MPR to be different. We work flexibly, have the authority to make decisions without passing the buck, and our underwriting skills are always at your disposal. What’s more, we believe in sharing knowledge and insight about financial lines as widely as possible.

Our aim? To make complex financial lines insurance a solid and accessible proposition for businesses all around Britain.

Our approach

Flexible pricing

Not all risks are standard, and not all pricing should be standardised. We are able to match the pricing to your client’s risk profile on an account-by-account basis.

So when computers say no, there’s a good chance we’ll say yes.

Flexible cover

One size doesn’t always fit all. We have the technical experience to tailor your clients’ cover according to individual circumstance. And we can take these coverage decisions quickly, without having to kick them up a large company’s chain of command.

Flexible approach

We are not bound by rigid hierarchies. Instead we’re as open as possible, giving you direct access to technical support, expert decision makers and our knowledge of financial lines. And whatever your clients’ needs, we’ll do our best to accommodate them.

What we cover

MPR has the technical experience to write a range of risks – small and large – covering a wide variety of financial lines.

And because we control what we do we can always keep our products right up to date, without having to wade through layers of bureaucracy. Over the years we’ve covered most kinds of risk. If you don’t see what you’re looking for here, please get in touch – there’s a very good chance we can help.

Our policies include:

- Directors & Officers Liability

- Management Risks package policies

- Cyber Liability

- Employment Practices Liability

- Pension Liability

- Pension Wind Up Liability

- Charity and Not for Profit Liability

- Professional Indemnity and Media Liability

- Public Offering or Prospectus Liability

- Financial Institutions Insurance

- Crime and Cyber Crime Insurance

5 reasons to consider MPR

Technical ability

We are experienced, accomplished underwriters with decades of technical expertise in financial lines.

Flexibility

You’ll have direct access to expert decision makers who can match the pricing and cover to your clients’ needs.

A national perspective

Based outside London, we’ve dealt with brokers from every market in the UK and Ireland.

A+ capacity

MPR’s capacity is provided by Axis Specialty Europe SE, rated A+ with a stable outlook by both Standard & Poor’s and A. M. Best.

A fair approach to claims

Our aim is to meet the expectations of both broker and policyholder. We know that the best way to do this is to keep lines of communication clear and open. In the event of a claim, you won’t find us hiding away.