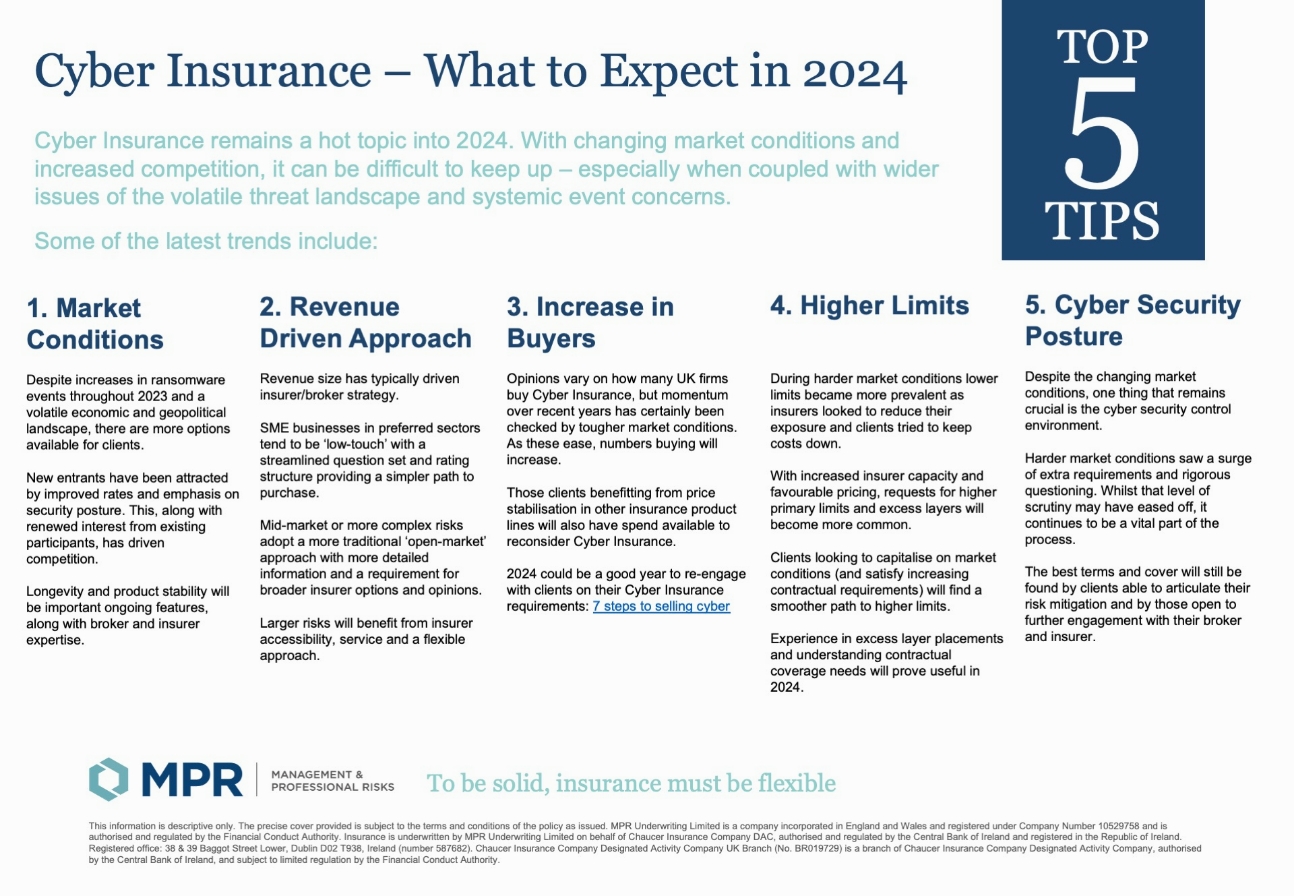

Cyber Insurance remains a hot topic into 2024. With changing market conditions and increased competition, it can be difficult to keep up – especially when coupled with wider issues of the volatile threat landscape and systemic event concerns. Some of the latest trends include:

1. Market Conditions

Despite increases in ransomware events throughout 2023 and a volatile economic and geopolitical landscape, there are more options available for clients.

New entrants have been attracted by improved rates and emphasis on security posture. This, along with renewed interest from existing participants, has driven competition.

Longevity and product stability will be important ongoing features, along with broker and insurer expertise.

2. Revenue Driven Approach

Revenue size has typically driven insurer/broker strategy.

SME businesses in preferred sectors tend to be ‘low-touch’ with a streamlined question set and rating structure providing a simpler path to purchase.

Mid-market or more complex risks adopt a more traditional ‘open-market’ approach with more detailed information and a requirement for broader insurer options and opinions.

Larger risks will benefit from insurer accessibility, service and a flexible approach.

3. Increase in Buyers

Opinions vary on how many UK firms buy Cyber Insurance, but momentum over recent years has certainly been checked by tougher market conditions. As these ease, numbers buying will increase.

Those clients benefitting from price stabilisation in other insurance product lines will also have spend available to reconsider Cyber Insurance.

2024 could be a good year to re-engage with clients on their Cyber Insurance requirements: 7 steps to selling cyber

4. Higher Limits

During harder market conditions lower limits became more prevalent as insurers looked to reduce their exposure and clients tried to keep costs down.

With increased insurer capacity and favourable pricing, requests for higher primary limits and excess layers will become more common.

Clients looking to capitalise on market conditions (and satisfy increasing contractual requirements) will find a smoother path to higher limits.

Experience in excess layer placements and understanding contractual coverage needs will prove useful in 2024.

5. Cyber Security Posture

Despite the changing market conditions, one thing that remains crucial is the cyber security control environment.

Harder market conditions saw a surge of extra requirements and rigorous questioning. Whilst that level of scrutiny may have eased off, it continues to be a vital part of the process.

The best terms and cover will still be found by clients able to articulate their risk mitigation and by those open to further engagement with their broker and insurer.