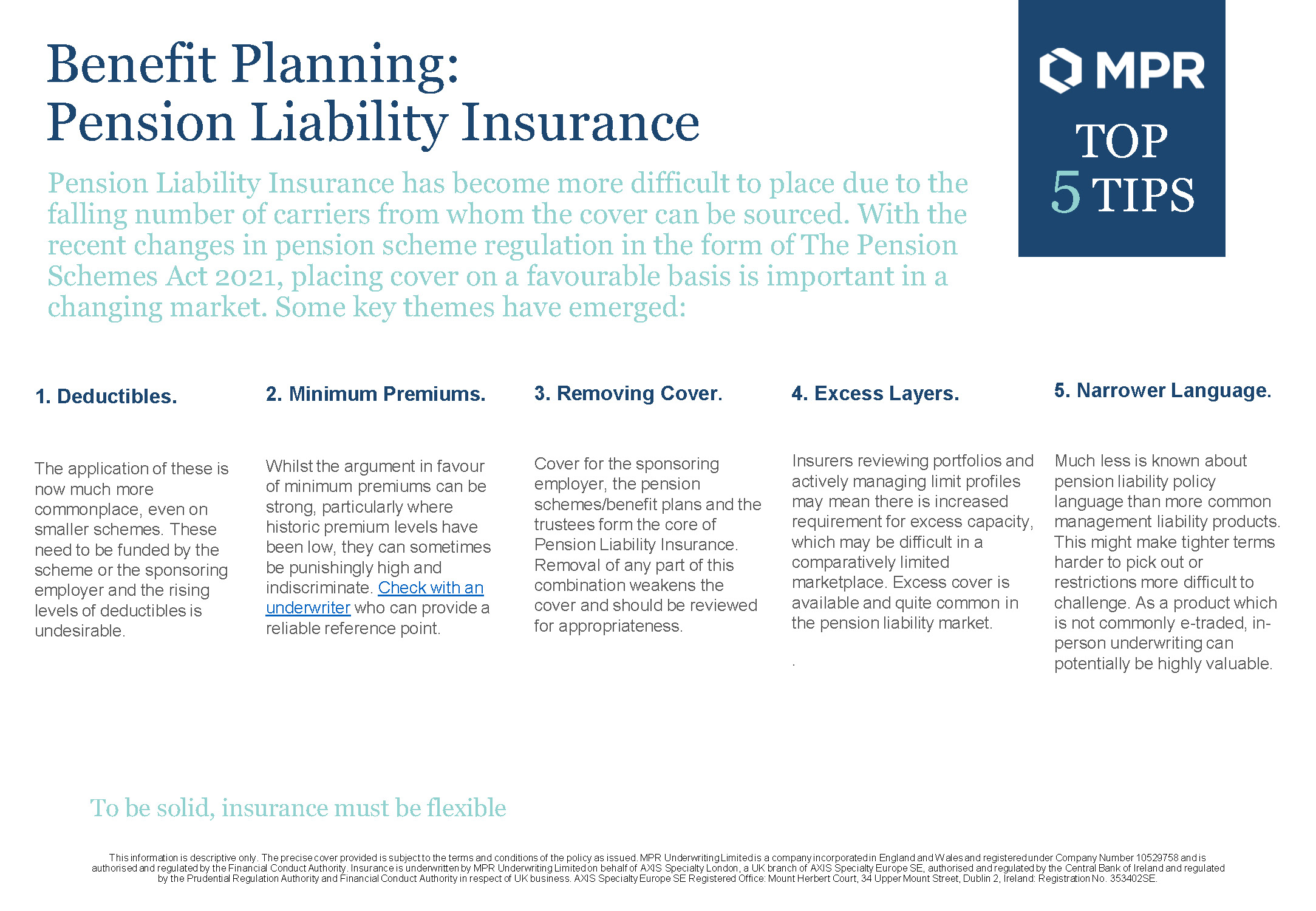

Pension Liability Insurance has become more difficult to place due to the falling number of carriers from whom the cover can be sourced. With the recent changes in pension scheme regulation in the form of The Pension Schemes Act 2021, placing cover on a favourable basis is important in a changing market. Some key themes have emerged:

1. Deductibles

The application of these is now much more commonplace, even on smaller schemes. These need to be funded by the scheme or the sponsoring employer and the rising levels of deductibles is undesirable.

2. Minimum Premiums

Whilst the argument in favour of minimum premiums can be strong, particularly where historic premium levels have been low, they can sometimes be punishingly high and indiscriminate. Check with an underwriter who can provide a reliable reference point.

3. Removing Cover

Cover for the sponsoring employer, the pension schemes/benefit plans and the trustees form the core of Pension Liability Insurance. Removal of any part of this combination weakens the cover and should be reviewed for appropriateness.

4. Excess Layers

Insurers reviewing portfolios and actively managing limit profiles may mean there is increased requirement for excess capacity, which may be difficult in a comparatively limited marketplace. Excess cover is available and quite common in the pension liability market.

5. Narrower Language

Much less is known about pension liability policy language than more common management liability products. This might make tighter terms harder to pick out or restrictions more difficult to challenge. As a product which is not commonly e-traded, in-person underwriting can potentially be highly valuable.