The turbulence within the Management Liability (‘ML’) market has intensified following a global pandemic quite unlike anything in living memory. Even after a round of price increases, rates are still materially lower than those from 10 years ago, so this looks set to continue.

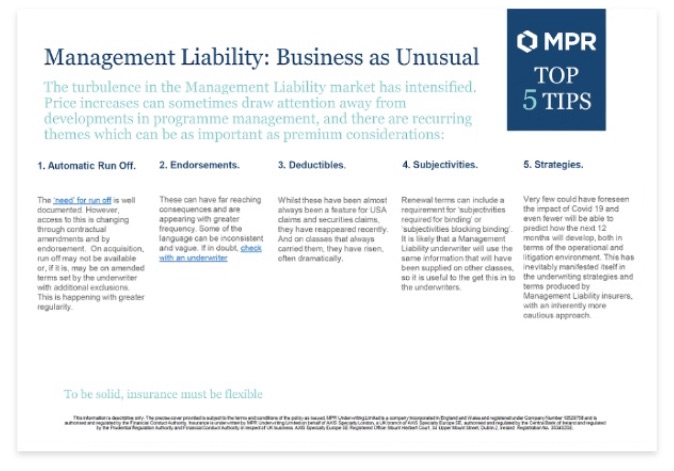

What this may do is draw attention away from developments in programme management, and we’ve recently discussed the potential implications of the reversion on AOC. Other patterns have emerged in this narrative, with 3 recurring themes:

The blanket application of insolvency exclusions: There is a paradox that those least concerned about insolvency risk are the most likely to accept an exclusion. More risk averse or less financially robust customers will understandably seek to avoid it. No one can see round corners, and despite the softening of the regulatory regime around insolvency, the application of the exclusion is not a desirable outcome in any scenario. Even if an exclusion is unavoidable, which can be the case in the current market, closer inspection is needed to examine potential ‘exclusion creep’. Badged as an insolvency exclusion, language can travel further and even remove cover for representations on liabilities or any other aspect of a financial position.

Discovery: Often called ‘extended reporting period’ (‘ERP’), this condition gives the policyholder the option to trigger ‘run off’ if they elect to non-renew their D&O programme. This might have been through a business conclusion event or, more relevant in the current market, if the best offer is commercially or constructively unattractive. Buying an extended period of ‘discovery’ offers a softer landing than simply stopping the cover dead. Simply put, if the insurer or the policyholder refuses to renew, the policyholder has an option to trigger the discovery/ERP for a predefined amount and period and preserve the expiring cover for wrongful acts or conduct that occurred/allegedly occurred prior to the date of non-renewal. To give the underwriter more control, a ‘unilateral’ discovery/ERP endorsement is applied, which only triggers in the event of the insurer refusing to renew, so a radical and transformational renewal offer still counts. There has been a substantial rise in the amendment or removal of discovery/ERP, so if the insurer decides to non-renew, the policyholder may be all out of options. It is more discreet than a price increase but can be profoundly impactful. It is also worth studying the body of the wording on run off, too. Some of these have changed and have resulted in some deeply uncomfortable conversations on acquisition.

Covid/communicable diseases exclusions: These are less prevalent but emerging more as a theme for obvious reasons. As always, lift the lid and inspect. Does it apply to all sections? It could have implications for reductions in workforce, insolvency, health and safety, IT matters and whistleblowing, amongst other things, if the causation can be linked to Covid 19. This theme will develop as the impact of the pandemic becomes clearer, both in terms of the economic damage and the claims landscape.

To discuss any of these matters in more detail, or for more information about our products and service please get in touch.