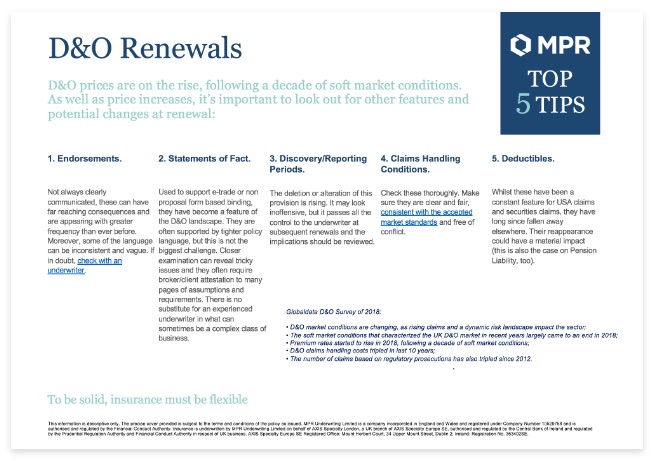

D&O prices are on the rise, following a decade of soft market conditions. As well as price increases, it’s important to look out for other features and potential changes at renewal.

1. Endorsements

Not always clearly communicated, these can have far reaching consequences and are appearing with greater frequency than ever before. Moreover, some of the language can be inconsistent and vague. If in doubt, check with an underwriter.

2. Statements of Fact

Used to support e-trade or non proposal form based binding, they have become a feature of the D&O landscape. They are often supported by tighter policy language, but this is not the biggest challenge. Closer examination can reveal tricky issues and they often require broker/client attestation to many pages of assumptions and requirements. There is no substitute for an experienced underwriter in what can sometimes be a complex class of business.

3. Discovery/Reporting Periods

The deletion or alteration of this provision is rising. It may look inoffensive, but it passes all the control to the underwriter at subsequent renewals and the implications should be reviewed.

4. Claims Handling Conditions

Check these thoroughly. Make sure they are clear and fair, consistent with the accepted market standards and free of conflict.

5. Deductibles

Whilst these have been a constant feature for USA claims and securities claims, they have long since fallen away elsewhere. Their reappearance could have a material impact (this is also the case on Pension Liability, too).

Globaldata D&O Survey of 2018:

- D&O market conditions are changing, as rising claims and a dynamic risk landscape

impact the sector; - The soft market conditions that characterized the UK D&O market in recent years largely

came to an end in 2018; - Premium rates started to rise in 2018, following a decade of soft market conditions;

- D&O claims handling costs tripled in last 10 years;

- The number of claims based on regulatory prosecutions has also tripled since 2012.