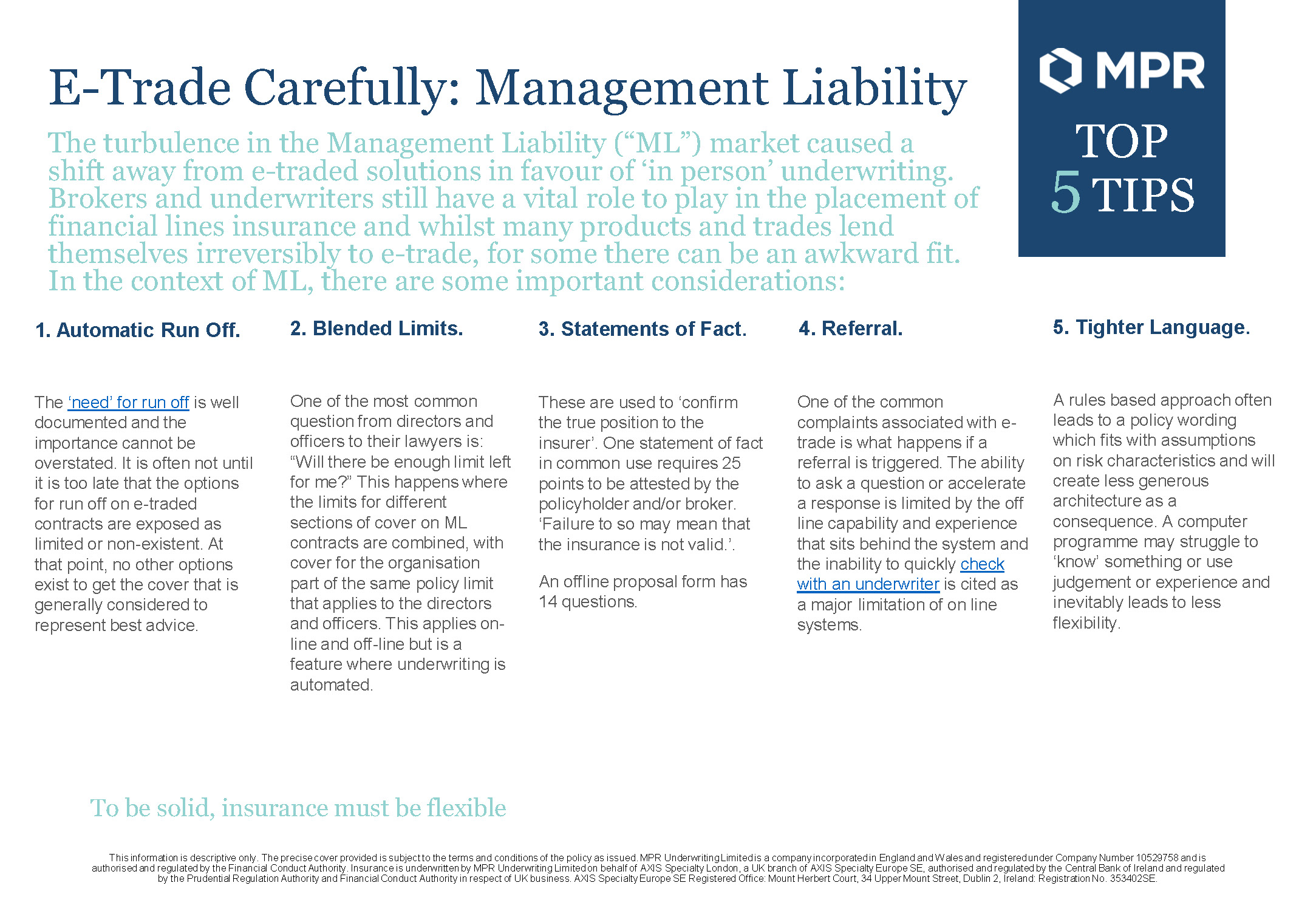

The turbulence in the Management Liability (“ML) market caused a shift away from e-traded solutions in favour of ‘in person’ underwriting. Brokers and underwriters still have a vital role to play in the placement of financial lines insurance and whilst many products and trades lend themselves irreversibly to e-trade, for some there can be an awkward fit. In the context of ML, there are some important considerations:

1. Automatic Run Off

The ‘need’ for run off is well documented and the importance cannot be overstated. It is often not until it is too late that the options for run off on e-traded contracts are exposed as limited or non-existent. At that point, no other options exist to get the cover that is generally considered to represent best advice.

2. Blended Limits

One of the most common question from directors and officers to their lawyers is:

“Will there be enough limit left for me?” This happens where the limits for different sections of cover on ML contracts are combined, with cover for the organisation part of the same policy limit that applies to the directors and officers. This applies on-line and off-line but is a feature where underwriting is automated.

3. Statements of Fact

These are used to ‘confirm the true position to the insurer’. One statement of fact in common use requires 25 points to be attested by the policyholder and/or broker.

‘Failure to so may mean that the insurance is not valid.’ An offline proposal form has 14 questions.

4. Referral

One of the common complaints associated with e-trade is what happens if a referral is triggered. The ability to ask a question or accelerate a response is limited by the off line capability and experience that sits behind the system and the inability to quickly check with an underwriter is cited as a major limitation of on line systems.

5. Tighter Language

A rules based approach often leads to a policy wording which fits with assumptions on risk characteristics and will create less generous architecture as a consequence. A computer programme may struggle to ‘know’ something or use judgement or experience and inevitably leads to less flexibility.