When considering what limits to choose under a Management Liability (“ML”) policy, much of the focus centres on the Directors and Officers (“D&O”) liability section. Much less attention is given to the Employment Practices Liability (“EPL”) section, despite the fact that most ML professionals will attest to this being the more frequently notified section of the policy. This might be attributable to the higher visibility that exists around EPL claim statistics, given that Employment Tribunals are the jurisdiction for all employment claims (and increasingly those for non-employees) but also perhaps because they do not involve the same perceived levels of personal financial risk to directors. Nonetheless, claims can be time consuming, expensive and highly emotive and consideration ought to be given to ensuring limits are carefully selected to avoid surprises. A range of factors exists when making this choice:

When considering what limits to choose under a Management Liability (“ML”) policy, much of the focus centres on the Directors and Officers (“D&O”) liability section. Much less attention is given to the Employment Practices Liability (“EPL”) section, despite the fact that most ML professionals will attest to this being the more frequently notified section of the policy. This might be attributable to the higher visibility that exists around EPL claim statistics, given that Employment Tribunals are the jurisdiction for all employment claims (and increasingly those for non-employees) but also perhaps because they do not involve the same perceived levels of personal financial risk to directors. Nonetheless, claims can be time consuming, expensive and highly emotive and consideration ought to be given to ensuring limits are carefully selected to avoid surprises. A range of factors exists when making this choice:

Prior Losses: this is perhaps more a function of the factors that follow, but if there is a pattern of claims or recurring themes within an organisation and costs can be identified against them, this can prove instructive.

Basis of cover: it is more than 10 years since the market moved to an any one claim (“AOC”) cover. With a lower average policy limit than D&O, the potential benefits of AOC are more obvious. Greater visibility exists on the costs associated with EPL claims, particularly if an organisation is only exposed to UK based staff. As EPL limits will typically be lower than those for D&O, the basis of cover exerts a much bigger influence on limit decision.

Activities: certain trades and sectors are disproportionately exposed to claims, to the point that some will be uninsurable. Public sector risks are unattractive, due in part to unique features of those environments, but those that were previously within the public domain, such as housing associations, education and the care sector will present a less attractive risk profile to underwriters. Weaker performance management, concentrated union membership and less transportable skill sets are just some factors in play. Salary levels will influence the risk, so law firms or those with higher than average earnings may be more exposed. Caps exist on the level of some claims, such as unfair dismissal, but those on higher salaries will reach those quicker.

Scale: many claims happen irrespective of what the employer may or may not do. It is simple probability that the greater the workforce, the greater the likelihood of a claim occurring. Of course, stronger policies that are more effectively communicated will help, but the less control and the less that Human Resources are ‘on the ground’ means the chances of a claim are higher, and the opportunity to deal with an emerging issue are lower.

Financial Profile: this will impact hiring and firing patterns. Redundancies are material to underwriters and will prompt examination of the process to ensure proper procedures have been followed. Some insurers will remove the risk entirely and seek solutions in exclusionary language and higher deductibles. Nonetheless, once a section limit is set, it is often difficult to persuade underwriters to increase it as circumstances change, so this should be considered up front.

Merger and Acquisition Activity: aligned with the previous point, most acquisitions will involve some assessment of duplication of resource. Whilst there is protection available under the TUPE regulations, there is often an inevitability to reductions in force and attempts to rationalise staffing levels following the combination of organisations.

Territory: location is a key consideration in any assessment of limits and the extent of any exposure to the United States (“US”) drives the risk profile more than any other territory. A US exposed risk can be materially different to one which is UK only, particularly if there is employment at scale (certain statutes only apply above a certain size). However, there can often be an overreaction to US exposure when underwritten from the UK and deductibles are often out of line with those that would apply in the local market. For that reason alone, it is often more cost effective to obtain a policy in the US, the terms for which are likely to be kinder than those applied remotely.

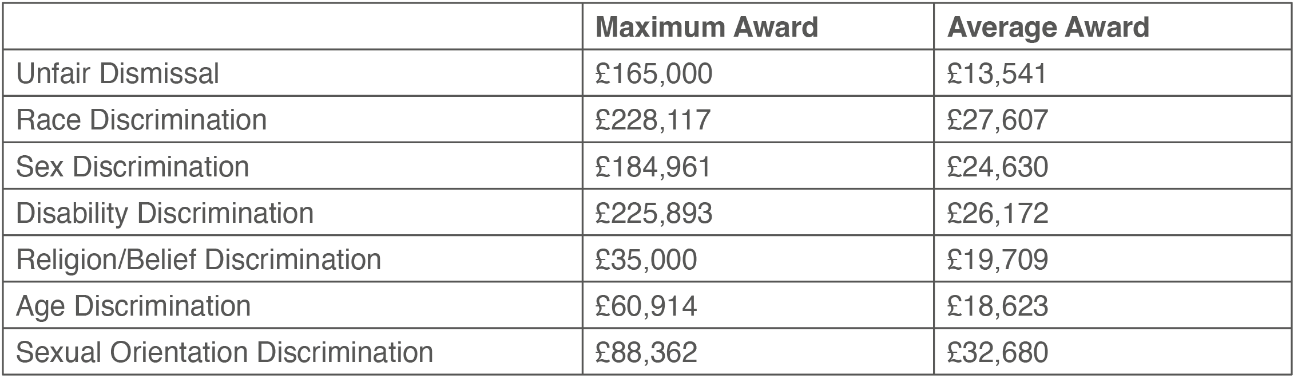

Regulatory Framework: the maximum and average employment awards in the UK are, for the most part, transparent and visible, and it is possible to get intelligence on costs. This makes it easier to formulate an idea on what the right limit to choose might be.

Maximum and Average Awards for Unfair Dismissal and Discrimination 2021/22:

Whatever the perceived rights and wrongs of a case, the number of costs awards made by Employment Tribunals is fractional at only 184 in 2021/22 (respondents (employers) having 134 costs awards awarded in their favour versus 50 in favour of claimants), the norm being that each party has to bear their own expenses. An assessment of the likely claim costs that are hidden from the ACAS statistics is therefore important. Taking unfair dismissal claims, it would be reasonable to assume that employers have also had to spend in the region of £8,000 to £12,000 in legal fees to defend the claim. Claims of discrimination have the potential to bring even larger awards of compensation and legal costs can easily reach £20,000. If the respondent has called a large number of witnesses to rebut the claimant’s allegations and a lengthy hearing (10 day) is needed, those legal costs can exceed £40,000.

It should be remembered that the statistics relate only to cases decided by the Employment Tribunal after a full hearing. The vast majority of cases will not make it that far and many will either have been settled or withdrawn at an earlier stage. The Ministry of Justice’s recent statistics (for the last quarter of 2022) show that there are currently almost 500,000 Employment Tribunal claims being brought against employers, with the number having now climbed back to pre-Covid levels. There is also a detectable rise in ‘hybrid’ cases, where discrimination is thrown in to sidestep the caps on other heads of claim. As with most management liabilities, the scenery is constantly shifting and there is now very specialised knowledge within the Employment Tribunal system. A recruitment drive sought candidates with over 3 years of employment law experience and the new intake see the world differently, which makes the job of the lawyers and the employers more difficult than it was in the past. Whilst this may not feed in to the metrics in the short term, the direction of travel seems clear.

From the perspective of the buyer, it is often the ‘bombshell claim’ that drives the limit choice and the risk factors feed in to both the likelihood and potential value. The chances of a claimant alleging a pattern of behaviours over a prolonged period can be a key feature of the high value cases. It is often not enough to have access to HR and having ‘boots on the ground’ can mitigate the potential for claims to happen in the first place. Insurance can help, but having solid employment practices is the best defence.