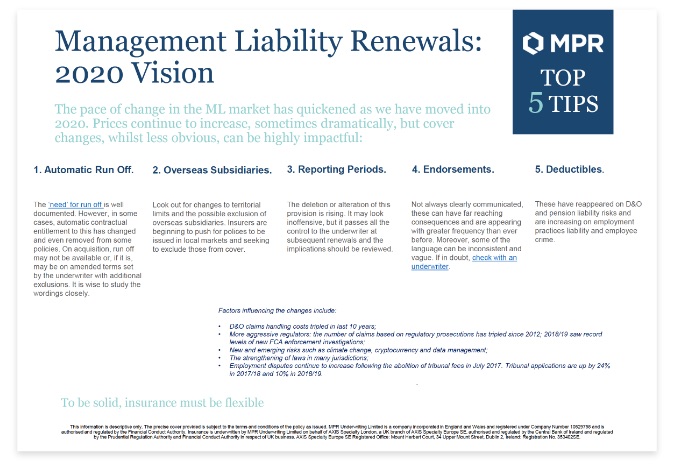

The pace of change in the ML market has quickened as we have moved into 2020. Prices continue to increase, sometimes dramatically, but cover changes, whilst less obvious, can be highly impactful:

1. Automatic Run Off.

The ‘need’ for run off is well documented. However, in some cases, automatic contractual entitlement to this has changed and even removed from some policies. On acquisition, run off may not be available or, if it is, may be on amended terms set by the underwriter with additional exclusions. It is wise to study the wordings closely.

2. Overseas Subsidiaries.

Look out for changes to territorial limits and the possible exclusion of overseas subsidiaries. Insurers are beginning to push for polices to be issued in local markets and seeking to exclude those from cover.

3. Reporting Periods.

The deletion or alteration of this provision is rising. It may look inoffensive, but it passes all the control to the underwriter at subsequent renewals and the implications should be reviewed.

4. Endorsements.

Not always clearly communicated, these can have far reaching consequences and are appearing with greater frequency than ever before. Moreover, some of the language can be inconsistent and vague. If in doubt, check with an underwriter.

5. Deductibles.

These have reappeared on D&O and pension liability risks and are increasing on employment practices liability and employee crime.

Factors influencing the changes include:

- D&O claims handling costs tripled in last 10 years;

- More aggressive regulators: the number of claims based on regulatory prosecutions has tripled since 2012; 2018/19 saw record levels of new FCA enforcement investigations;

- New and emerging risks such as climate change, cryptocurrency and data management;

- The strengthening of laws in many jurisdictions;

- Employment disputes continue to increase following the abolition of tribunal fees in July 2017. Tribunal applications are up by 24% in 2017/18 and 10% in 2018/19.