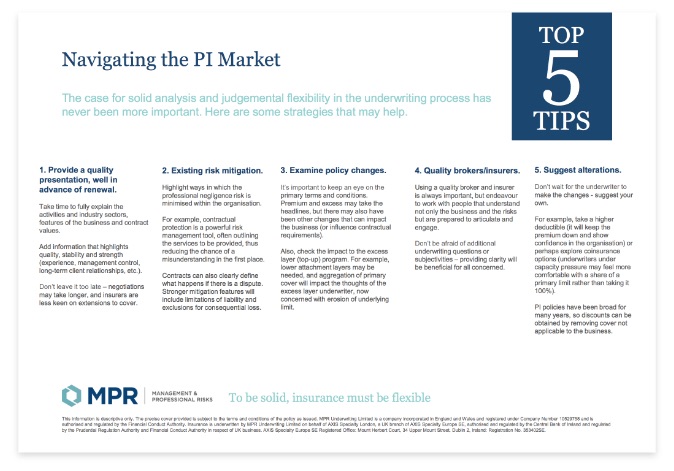

The case for solid analysis and judgemental flexibility in the underwriting process has never been more important. Here are some strategies that may help.

1. Provide a quality presentation, well in advance of renewal.

Take time to fully explain the activities and industry sectors, features of the business and contract values.

Add information that highlights quality, stability and strength (experience, management control, long-term client relationships, etc.).

Don’t leave it too late – negotiations may take longer, and insurers are less keen on extensions to cover.

2. Existing risk mitigation.

Highlight ways in which the professional negligence risk is minimised within the organisation.

For example, contractual protection is a powerful risk management tool, often outlining the services to be provided, thus reducing the chance of a misunderstanding in the first place.

Contracts can also clearly define what happens if there is a dispute. Stronger mitigation features will include limitations of liability and exclusions for consequential loss.

3. Examine policy changes.

It’s important to keep an eye on the primary terms and conditions. Premium and excess may take the headlines, but there may also have been other changes that can impact the business (or influence contractual requirements).

Also, check the impact to the excess layer (top-up) program. For example, lower attachment layers may be needed, and aggregation of primary cover will impact the thoughts of the excess layer underwriter, now concerned with erosion of underlying limit.

4. Quality brokers/insurers.

Using a quality broker and insurer is always important, but endeavour to work with people that understand not only the business and the risks but are prepared to articulate and engage.

Don’t be afraid of additional underwriting questions or subjectivities – providing clarity will be beneficial for all concerned.

5. Suggest alterations.

Don’t wait for the underwriter to make the changes – suggest your own.

For example, take a higher deductible (it will keep the premium down and show confidence in the organisation) or perhaps explore coinsurance options underwriters under capacity pressure may feel more comfortable with a share of a primary limit rather than taking it 100%).

PI policies have been broad for many years, so discounts can be obtained by removing cover not applicable to the business.