MPR’s CIRI policy specifically has an ‘Immediate Incident Response Expenses’ definition, because we want the policyholder to act without hesitation, even if they feel they may be able to handle it themselves. To facilitate this, we deliberately apply a £0 deductible applicable to this service, and it won’t cons tit ute a notification to MPR unless the severity means that it progresses to the crisis management stage.

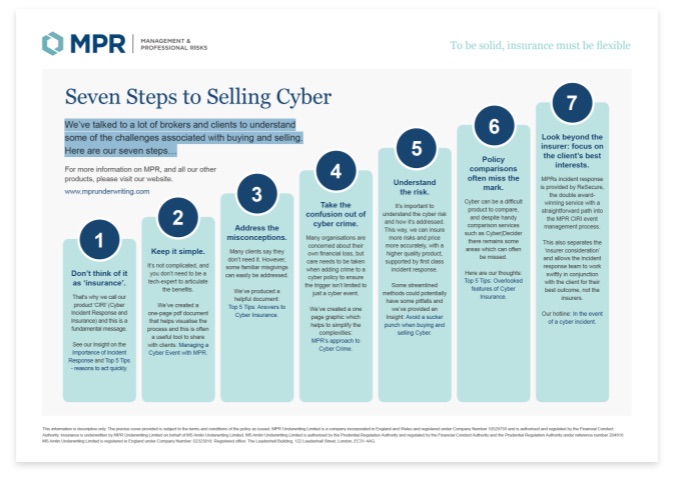

1. Don’t think of it as ‘insurance’.

That’s why we call our product ‘CIRI’ (Cyber Incident Response and Insurance) and this is a fundamental message.

See our Insight on the Importance of Incident Response and Top 5 Tips – reasons to act quickly.

2. Keep it simple.

It’s not complicated, and you don’t need to be a tech-expert to articulate the benefits.

We’ve created a one-page pdf document that helps visualise the process and this is often a useful tool to share with clients: Managing a Cyber Event with MPR.

3. Address the misconceptions.

Many clients say they don’t need it. However, some familiar misgivings can easily be addressed.

We’ve produced a helpful document: Top 5 Tips: Answers to Cyber Insurance.

4. Take the confusion out of cyber crime.

Many organisations are concerned about their own financial loss, but care needs to be taken when adding crime to a cyber policy to ensure the trigger isn’t limited to just a cyber event.

We’ve created a one page graphic which helps to simplify the complexities: MPR’s approach to Cyber Crime.

5. Understand the risk.

It’s important to understand the cyber risk and how it’s addressed. This way, we can insure more risks and price more accurately, with a higher quality product, supported by first class incident response.

Some streamlined methods could potentially have some pitfalls and we’ve provided an Insight: Avoid a sucker punch when buying and selling Cyber.

6. Policy comparisons often miss the mark.

Cyber can be a difficult product to compare, and despite handy comparison services such as Cyber|Decider there remains some areas which can often be missed.

Here are our thoughts: Top 5 Tips: Overlooked features of Cyber Insurance.

7. Look beyond the insurer: focus on the client’s best interests.

MPRs incident response is provided by ReSecure, the double award-winning service with a straightforward path into the MPR CIRI event management process.

This also separates the ‘insurer consideration’ and allows the incident response team to work swiftly in conjunction with the client for their best outcome, not the insurers.

Our hotline: In the event of a cyber incident.