Hidden in the depths of most Directors and Officers Liability (“D&O”) policies is a clause granting cover for Outside Directorship Liability (“ODL”). It is a seldom discussed provision but it has been a staple ingredient of D&O for many years. Extensions like this may have a tendency to make policy wordings longer and slightly less digestible, but they can provide valuable comfort when directors take on appointments on external boards that are ancillary to their main roles. And whilst the perceived risk may be low, it is still a worthwhile inclusion, particularly if it is well crafted.

Within the operating environment of some organisations, there may be a requirement to represent that organisation on an ‘outside’ board of directors. The most important requirement for cover under any D&O policy is that activity must be in the ‘insured capacity’ of an insured person, and ODL is no different, requiring also that any such appointments are maintained with the consent and knowledge of the organisation that ‘provides’ the insured person and holds that D&O policy. Historic and often hard to meet requirements such as a ‘written request’ or that there must be a held shareholder percentage have fallen away in modern policy iterations and have made ODL cover more ‘hands free’ and accessible (although this criteria still exists in some wordings).

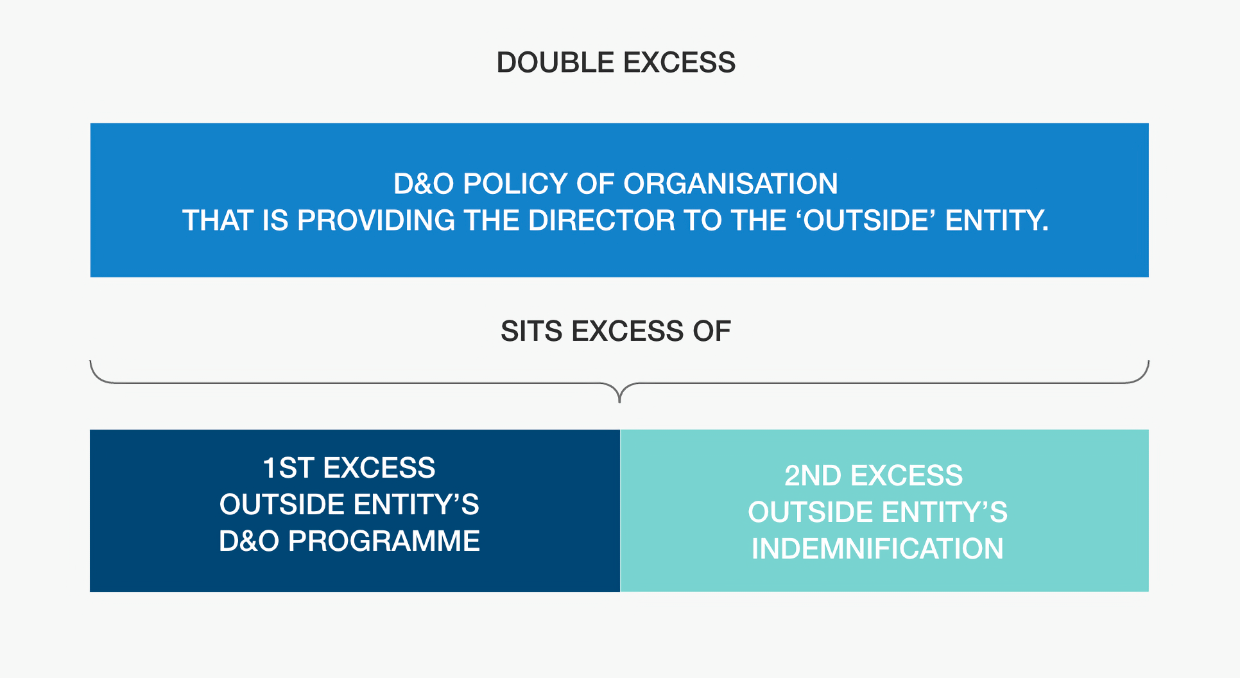

The standard indemnity afforded to directors and officers in their day to day roles will usually extend to any appointments taken in an outside entity. This means that an organisation should pay for any loss that a director or officer may personally incur as a result, and this is done in the usual way through the articles of association and the D&O policy (which mirrors the articles). However, the mechanics of ODL cover are different to those of regular D&O claims and such cover is not ‘direct’. This position exists for understandable reasons and typically operates though the ‘double excess’ framework. As one might expect, outside entities may also purchase D&O and all directors should automatically fall within the scope of this policy, so this is the first place to seek cover (this policy is the ‘first excess’). If D&O cover does not exist, or it fails/is exhausted then cover for any loss falls to any other indemnification provided by the outside entity, operating through the by-laws or articles of association of that outside entity (the ‘second excess’).

Cover will not extend to the balance of the outside board, which is logical and which follows a clear line of sight on insurable interest.

Whilst examples of ODL losses are not easy to find, they most definitely do happen, including:

- A company acquired a minority interest in another company and the CEO was appointed to be a director. Bankruptcy followed and the liquidator issued a claim for damages against the full board of directors of the outside company, including the CEO. Costs were £120,000 and damages £211,000.

- Proceedings alleged that the defendants breached their fiduciary duties of due care and engaged in a bad faith scheme to take control and ownership of the plaintiff. It was alleged that the outside director interfered with efforts made by the plaintiff to bring a new product to the market place to deliberately push them to the brink of insolvency. Claim costs were almost £500,000.

Of course, not all D&O claims are publicly disclosed, so the incidence is likely to be higher. Mention must also be made of the acute importance of ODL cover in the area of Private Equity and Venture Capital (“PE & VC”) firms. Although typical policies operate in the same way (double excess), PE & VC firms are more likely to find themselves exposed from the “ground up” for any claims coming against the portfolio company boards on which they sit. It is not surprising to see a higher incidence of ODL claims in the PE & VC arena than outside of it.

Notwithstanding that anomaly, the ODL risk remains low when compared to the native, day to day exposures organisations face. That said, not all D&O policies have the ODL provision and those that do may not have the cover configured in a manner that allows a genuinely hands free framework.